The hotel industry is a vast and global industry that encompasses a range of establishments from simple accommodation providers to luxurious hotels, resorts and stand-alone villas. Hotels offer various amenities, including spa, restaurant and bar, event planning, and other related services. The hotel industry relies heavily on tourism and business travel, as well as other forms of revenue, such as conferences and special events. In this guide, you will learn how to write a successful hotel business plan.

Wondering why business plan is essential for your company? Check out the benefits of writing your business plan.

Write Hotel Business Plan by following these 8 Steps:

Want to explore and understand the structure of any specific type of business plan? Check out different types of business plans we offer.

1. Write the Executive Summary

The executive summary is the most essential component of your business plan. It’s the first impression of the reader about your idea or company, so it can make or break your chances of success.

The purpose of the executive summary is to summarize the entire hotel business plan over 2-3 pages. It should be concise, clear, and informative, in order to pique the interest of the prospective readers and compel them to read the rest of the business plan. In the executive summary section of the business plan, the reader primarily seeks information on the following areas:

- What is the general overview of your hotel?

- What is the hotel industry size and trends?

- What are the company’s short, mid-term and long-term objectives?

- What are the factors that will be crucial for your hotel success?

Let’s dive into each one of these sections and explore more details.

Want to know what makes a good executive summary? Check out qualities of a good executive summary.

1.1 Company Overview

Company overview section shall briefly explain the legal structure, date of incorporation, founders, products and services and other company-related information. You shall provide sufficient information for the reader to gain a clear understanding of the subject company.

1.2 Industry Overview

Industry overview shall briefly describe the market size, market trends and industry growth forecasts. This section shall aim to provide a clear market validation to gain the interest of the reader.

1.3 Objectives

Objectives are key milestones that your company wants to achieve in the short to long-term. Your objectives should be clear and measurable. These can be further classified into three segments:

- Strategies objectives: These objectives are related to your strategy and how you intend to take on the market to claim a respectable market share.

- Operational objectives: These objectives are related to your company’s core operations including its human resource demand, facility, equipment and other operational expansion.

- Financial objectives: These objectives are related to the money that your company will make as well as its estimated net worth over the next few years.

1.4 Key Success Factors

Your company’s success may depend upon several factors. For example, your success may be contingent upon the “customer review score”. You shall understand factors that will influence your success and devise appropriate strategies to turn them into your favor.

2. Prepare the Company Description

Company description shall plainly explain who you are and what you do. In the company description section of the business plan, the reader primarily seeks information on the following areas:

- What is your hotel history (if any)?

- What is your hotel mission statement?

- Who are the company’s owners and financiers?

- Who will manage and oversee the company’s operations?

- What are your business partners, associates and advisors?

Let’s dive into each one of these sections and explore more details.

2.1 Business History

If the company is already operating, it is imperative to provide glimpses of its history. You may consider providing the following information:

- Date of commencement

- Major achievements

- Awards and recognitions

- Financial performance

- Similar other information

If you don’t have a trading history, you may consider providing progress that has been made on developing your business idea, including market research, surveys and building a team of co-founders, among others, with a proper timeline. These activities prove that you are genuinely interested in implementing your business plan.

2.2 Mission Statement

Mission statement will tell the reader about the purpose of your company i.e., why it does what it does. A good mission statement is always clear, succinct and meaningful that leaves a strong impact in the mind of the reader.

2.3 Ownership and Financiers

To make it easy for the reader to understand your equity composition, provide a list of shareholders with their names, percentage holding in the company, investment contribution and job roles.

Also, use this section to provide information about any external investors that your company might have which may also include institutional investors and lenders such as VCs, equity firms or banks.

2.4 Management Team

This section shall provide clear information about the key personnel who will be responsible for managing the company. You shall provide their background information including experience and qualification which will further improve their credibility of your business plan. The management team includes:

- Founder(s)

- Board of directors

- C-level executives

2.5 Partners, Associates and Advisors

Your business may need support from third-party companies to function. For example, your business partners could include suppliers or vendors; associates could include affiliate partners that send you regular customers; and advisors could include lawyers and accountants who are responsible for providing you legal and financial services respectively.

2.6 Other Company Information

Additional details that you may consider providing in this section include:

- Legal structure and why you have opted for it

- State and country of incorporation

- Logo and branding

- Trademarks and IPs

Recommended: When you think about starting a new business, the first thing you would probably do is to incorporate a company. Company incorporation can be extremely complex and time consuming. Save your time and money by using a professional company incorporation service such as ZenBusiness, LegalZoom or Incfile.

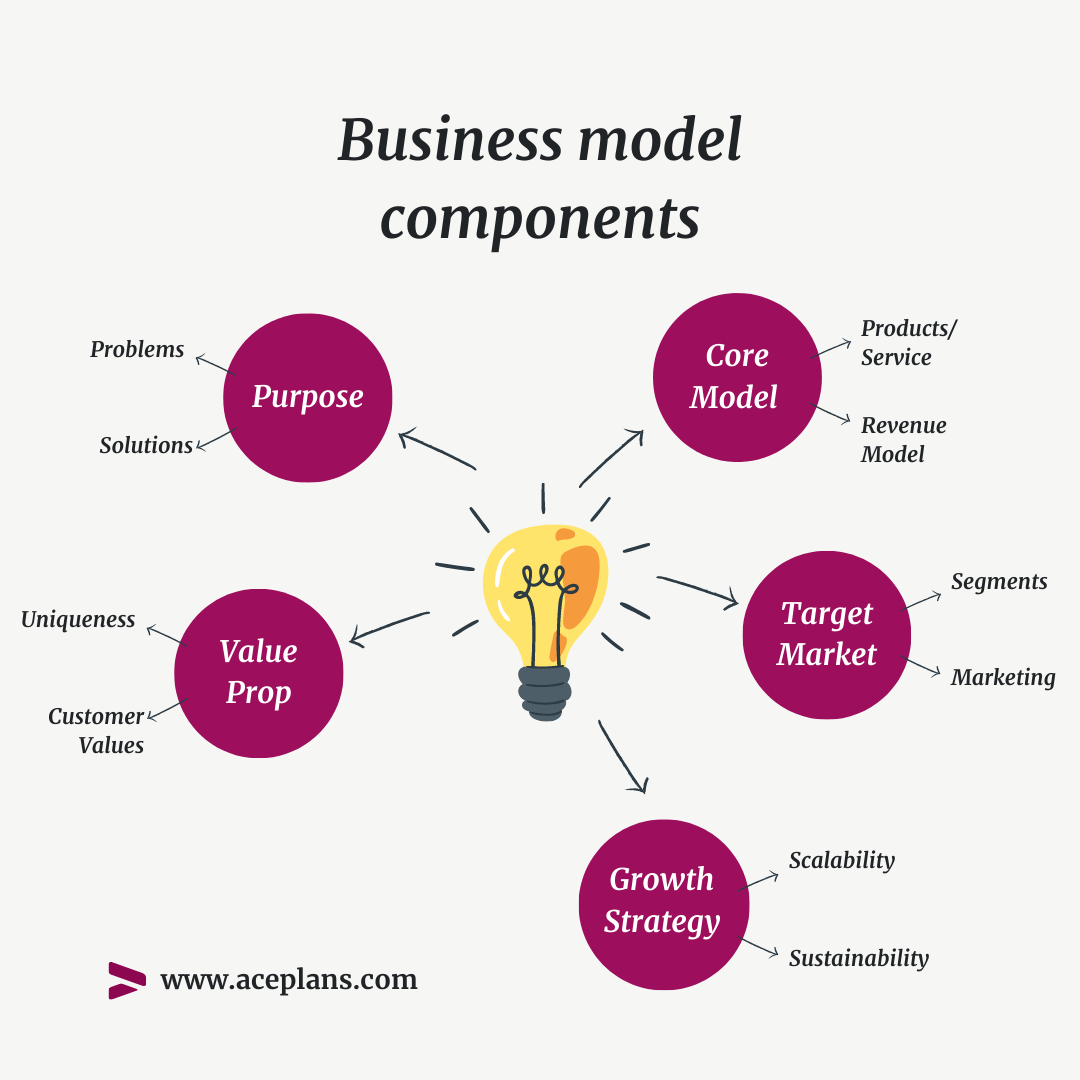

3. Flesh Out The Business Model

The purpose of this section is to educate the reader about your offerings and how your hotel business will make income. In the business model section of the business plan, the reader primarily seeks information on the following areas:

- What are the key market problems your hotel will solve?

- What are your hotel products and services?

- How will you deliver more value to your customers?

- What is your target market?

- How would you scale your hotel, nationally as well as internationally?

Let’s dive into each one of these sections and explore more details.

3.1 Outline the Purpose of Business Model

Explain why you have chosen this particular model and why it is the best fit for your business. Back your arguments with identifying “market pains” that you intend to address through your unique offerings.

3.2 Explain the Core Elements of Business Model

Describe the key components such as the products/services you offer, product/service features or properties, your pricing model, the channels you use to sell your products/services, and other key information about your company’s products/services.

3.3 Describe Value Proposition

Explain what makes your business model unique and how it delivers more value to customers. A strong value proposition should be compelling, concise, and tailored to the customer’s individual needs.

3.4 Define Target Market

Outline the customer segment you are targeting and how you would reach out to them. To define the target market, you should consider demographics, interests, lifestyle, location, income, and other factors that can help to identify the ideal customers.

3.5 Plan Growth Strategy

Describe how you plan to scale your business model and what steps you will take to ensure sustainable growth. The best way to explain your growth strategy is to classify it into various stages with a timeline, measurable targets and objectives for each stage.

4. Analyze the Market

Market analysis is essential to understand the external environment of the company in which it operates. It enables you to identify market gaps, understand risks and discover factors that drive the revenue in the industry, as well as to develop successful business strategies. In the market analysis section of the business plan, the reader primarily seeks information on the following areas:

- What is the market size and trends in the hotel industry?

- What are the key factors that drive revenue in the hotel industry?

- Who are your main competitors and how would you outperform them?

- What are strengths, weaknesses, opportunities and threats for your hotel?

Let’s dive into each one of these sections and explore more details.

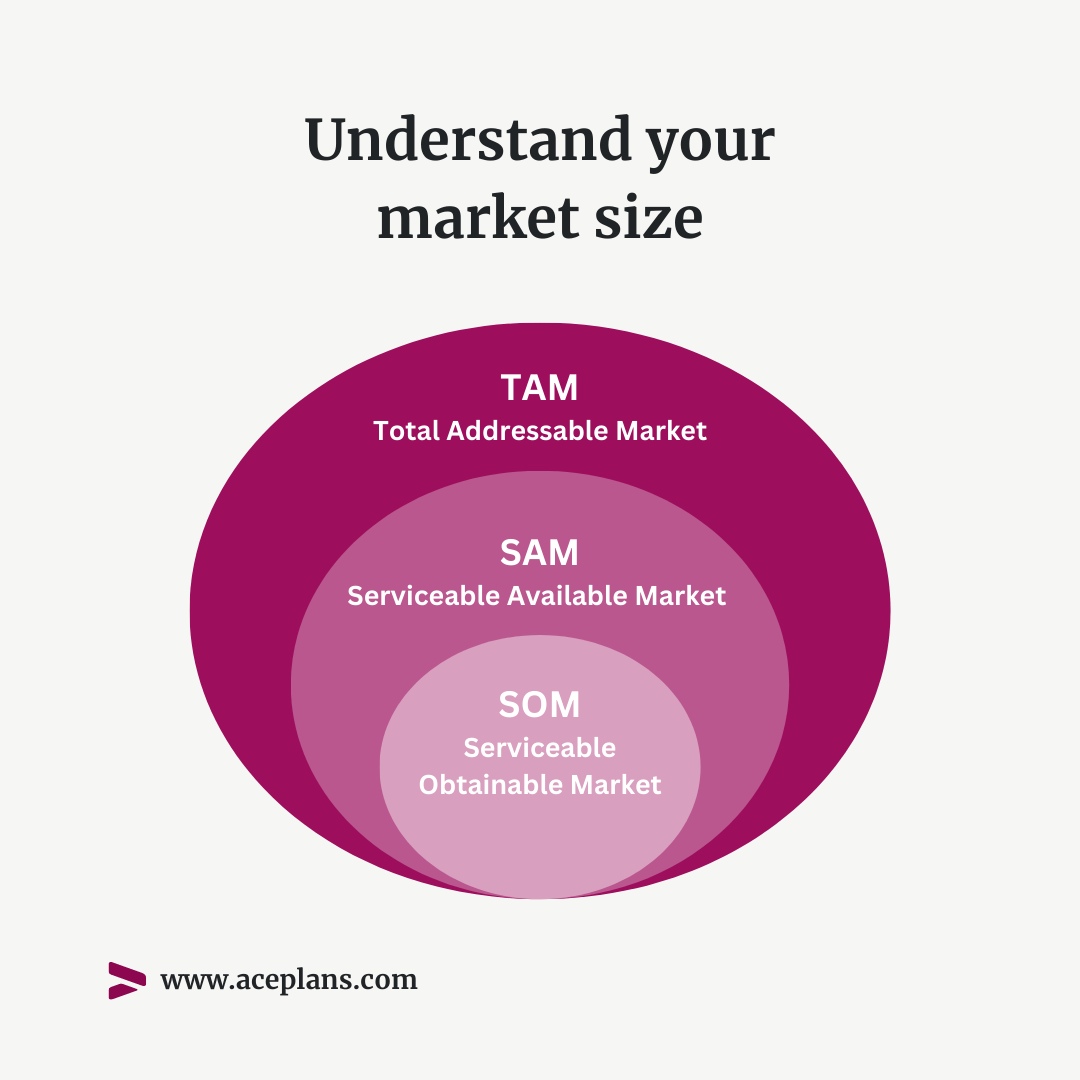

4.1 Assess Your Market Size

Estimate the size of your industry and check historical and future growth trends, especially for the niche segment of the industry you target. Try to discover your TAM, SAM and SOM:

- TAM: It stands for Total Addressable Market. It indicates the total size of the market that you could eventually reach. For example, targeting all males aged 18-35 years worldwide.

- SAM: It stands for Serviceable Available Market. It’s a segment of TAM which is within your geographical reach. For example, targeting all males aged 18-35 years in the US.

- SOM: It stands for Serviceable Obtainable Market. It’s a smaller segment of SAM which can be easily targeted. For example, targeting all males aged 18-35 years in the top five universities in Virginia state.

4.2 Analyze Industry Trends

Industry trend analysis can help you get an instant idea of what’s gaining popularity in your target market. Consider checking technological advancements, changing customer preferences, and economic indicators to unearth hidden patterns and trends. Try to gain a first-mover advantage by capitalizing on any new trend in the market.

4.3 Identify Revenue Drivers

There are several factors that drive the industry revenue. These factors vary depending upon your product/service type. For example, your product/service may be positively correlated with the consumer’s disposable income, hence a drop or increase in consumer disposable income will influence your company’s ability to generate income. Keep an eye on factors that could impact your revenues and devise appropriate strategies to grow.

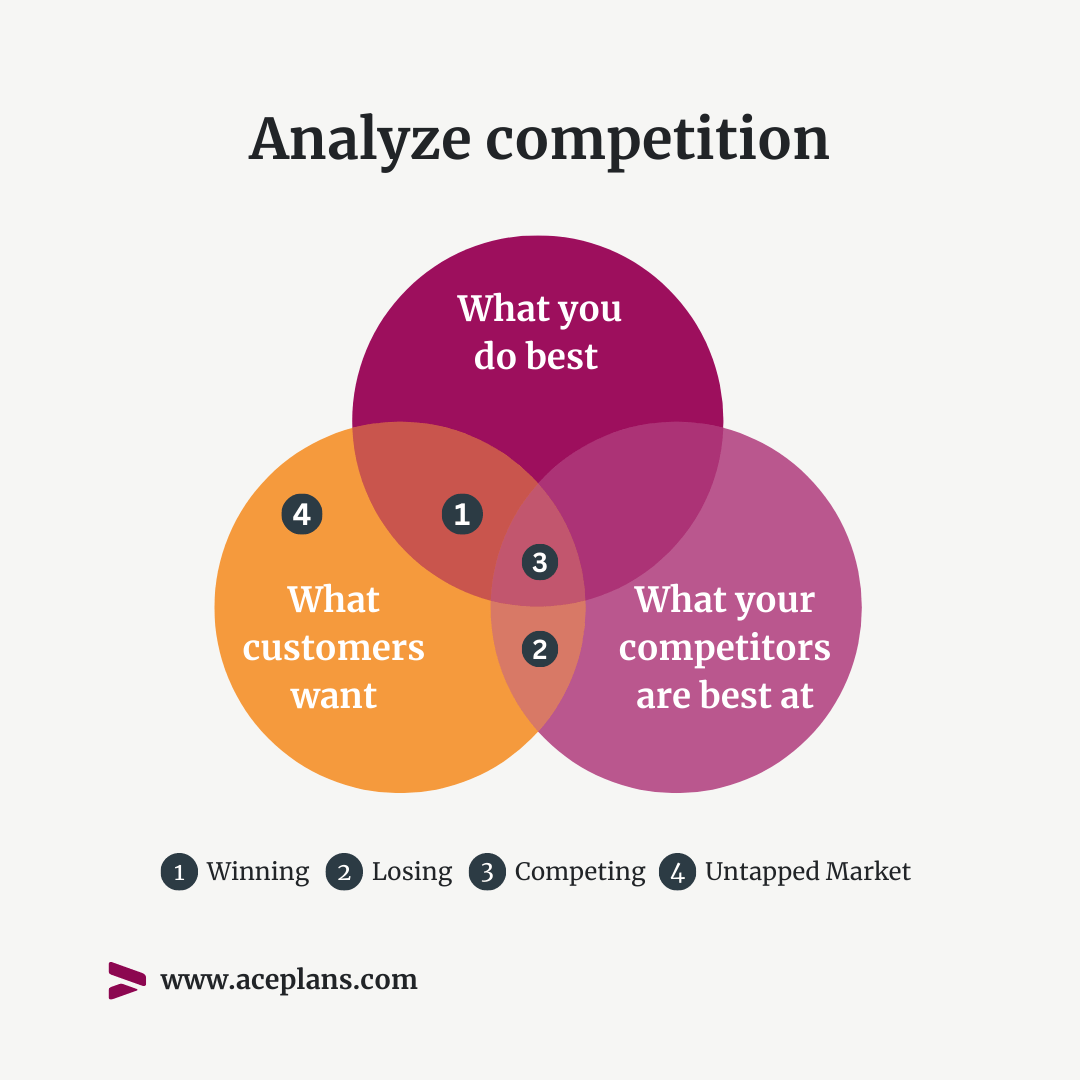

4.4 Evaluate Your Competitors

Research your competitors’ offerings and pricing strategies. Also, review the marketing materials they use to reach their customers. Draw a head-to-head comparison of your product/service with those of competitors to understand how you stack up against them.

4.5 Perform SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities and threats. It’s an all round analysis of the company’s internal (strengths and weaknesses) and external operating conditions, enabling you to take advantage of what you have to minimize your business risks.

How do we perform the market research? Aceplans uses premium research databases such as IBISWorld to gather the market data and insights for its business plan. IBISWorld research is trusted by top credit institutions, VCs, investors and academia.

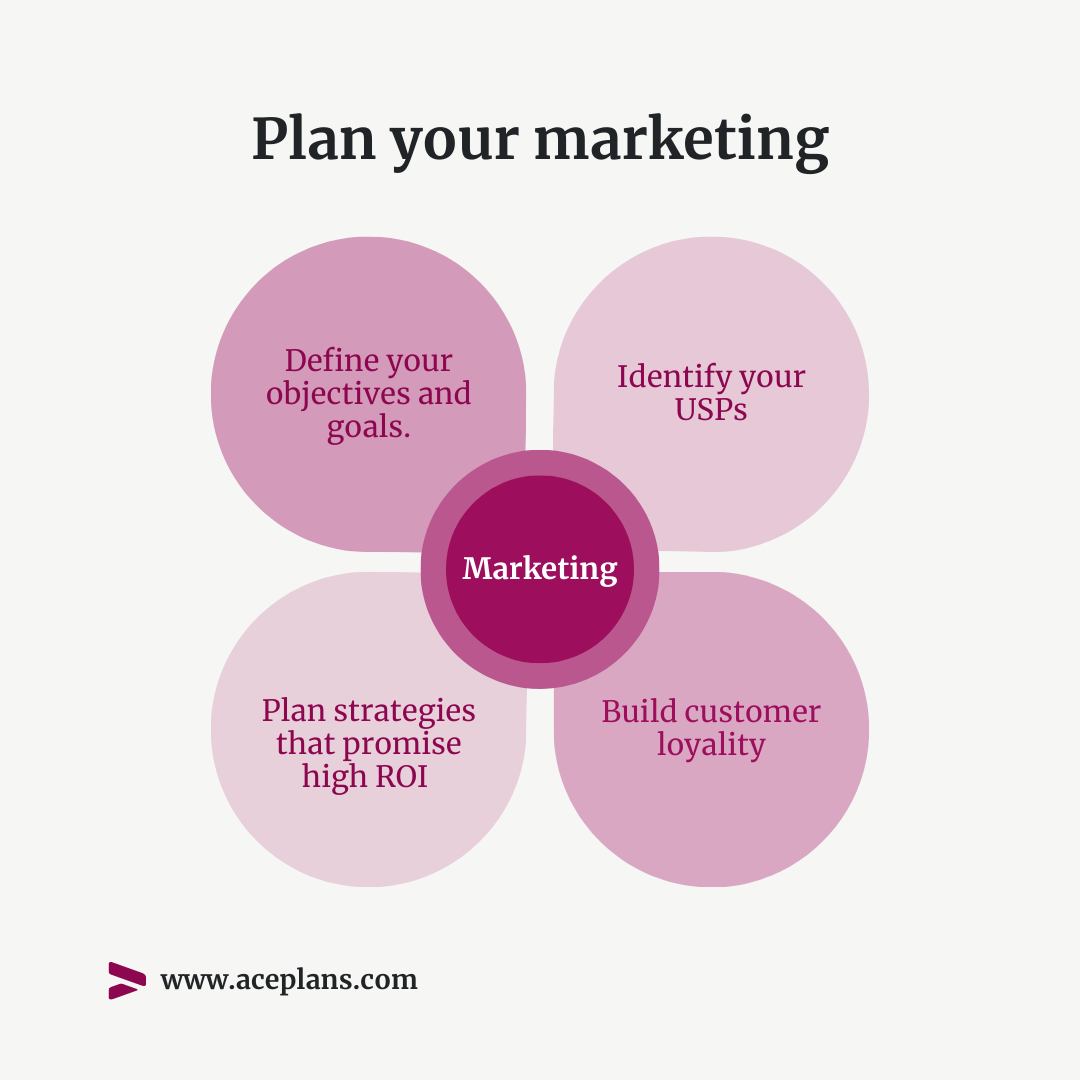

5. Develop the Marketing Plan

Marketing plan gives your business direction, provides a blueprint for achieving your goals and helps you track and measure your performance.

The first step in developing a strong marketing plan is to define your goals and objectives. These should be clear, measurable, and attainable. Lay out short and long-term goals of your business.

Once you know your goals, the next step is to identify your unique value propositions (USPs) that set you apart from competitors. Your USPs will tell your prospects “why” you are better, enabling you to convert leads into sales.

After knowing your USPs, the next step is to create a marketing strategy. This should include a mix of traditional and digital marketing tactics. Focus on fewer, yet effective, marketing strategies to efficiently use your marketing budget and maximize ROI.

Finally, you need a plan to build customer loyalty. It is either through offering your existing customers regular discounts or a lucrative commission when they refer a customer to you that results in a sale. The eventual objective should be to maximize the customer lifetime value (CVL).

6. Describe the Operations

Your hotel business plan shall detail the basic logistical requirements to run your company’s day to day operations. In the operations section of the business plan, the reader primarily seeks information on the following areas:

- What’s your hotel location?

- What type of licenses and permits are required to run a hotel?

- What type of software and equipment is needed for your hotel?

- What is your HR requirement to run a successful hotel?

- What would be the company’s organizational structure?

Let’s dive into each one of these sections and explore more details.

6.1 Location and Premises

Determine a location to establish your hotel, as well as the size of the property you will need. The property size will depend upon your room and amenities requirements such as restaurant, bar, spa, swimming pool, gym, etc.

6.2 Licenses and Permits

Prepare a list of licenses and permits that your business might need to obtain to operate legally in your country. The requirements may vary from country to country and state to state within the same country.

6.3 Software and Equipment

What sort of software and equipment are needed to launch and manage your company’s operations? This includes, but not limited to, machines & equipment, furniture & fixtures, security devices, vehicles as well as software such as productivity software, operations software, customer relation management (CRM) software, enterprise resource planning (ERP) software, communication software and others. Create a list of software and equipment, find suppliers and vendors and provide their details in the business plan.

6.4 Human Resource Planning

Forecast your staffing requirements, including job roles, headcount and salaries and estimate total number of workers and wages to plan your other operations accordingly.

6.5 Corporate Hierarchy

Create a corporate hierarchy that will ensure smooth functioning of your company’s operations.

7. Create the Financial Plan

Financial plan helps you, and your investors if seeking external funding, envisage the company’s financial performance over its first 3-5 years. In the financial plan section of the business plan, the reader primarily seeks information on the following areas:

- What are the fundamental assumptions that were made to project the hotel financials?

- How much funding is required to start a new hotel?

- What is the minimum revenue your hotel needs to achieve to become profitable?

- What is the expected turnover over the next 3-5 years?

- What is the expected profit over the next 3-5 years?

- What is expected net cash flow and period-end cash balance over the next 3-5 years?

- What is the expected financial position of your hotel over the next 3-5 years?

Let’s dive into each one of these sections and explore more details.

7.1 Underlying Assumptions

As a start-up, your company will lack prior trading history. As a result, you may have to make certain assumptions to project your company’s financials. It is important to make logical and realistic assumptions and effectively convey the same to the reader for better understanding.

7.2 Funding Requirements

When starting a new company, it is crucial to understand its funding requirements. For this, you shall create a start-up cost summary to estimate your company’s capital requirements at its inception. The start-up cost summary is usually classified into the following three segments:

- Start-up expenses: These expenses refer to initial spendings that will be incurred to set up a company. These include company registration, legal and professional fee, location (lease/rent and realtor fee), marketing and advertising, employees hiring and training, insurance, travel and miscellaneous expenses.

- Start-up assets: These are costs that are also incurred at start-up, but the economic value derived from them in the company’s operations lasts longer. These include long-term assets such as machines & equipment and furniture & fixtures as well as short-term assets such as inventory or raw material purchases.

- Working capital: Any part of capital which is left after spending cash on start-up expenses and assets will make up your company’s working capital. The working capital is extremely important to support your business operations after its launch when cash generation from sales will be low and operating expenses will be high. Hence, you shall plan your total funding requirements after considering a reasonable share for working capital.

7.3 Break-even Analysis

Break-even indicates minimum revenue that your company shall achieve to avoid a loss. At break-even, you will neither make a profit nor loss. Usually, the break-even is estimated by “quantity” and “value” which is then visually drawn on a chart.

7.4 Sales Forecast

Project your company’s turnover over the next 3-5 years. It’s vital to provide a detailed breakdown of your sales forecast (monthly or quarterly) for the first two years, followed by yearly projections for year 3-5. There are 3 popular methods to forecast sales:

- Use industry benchmarks: Consider industry ratios to realistically forecast your company’s sales. For example, if you have 4 employees while industry revenue per employee is $25,000, you shall realistically target $100,000 in turnover. Similarly use other industry ratios, such as return on equity, and take into consideration your variables to estimate realistic turnover.

- Top-down sales forecast: In this forecasting strategy, you look at the larger market and assume a realistic market share to estimate your revenue. For example, your TAM is $1b and you target 1% market share in year 1, giving you a sales forecast of $1m.

- Bottom-up sales forecast: It’s the simplest method to forecast sales revenue for a company. In this method, you carefully estimate when and how much quantity of each product/service you expect to sell. Then multiply the estimated quantities with average unit prices for each product/service category to forecast the turnover. For example, you expect to sell 20 units of your product A with an average price of $20 in month 1, your gross turnover from a single product will be $400.

7.5 Profit and Loss

Profit and loss projection will help you estimate your gross and net profits and calculate margin percentages:

- Gross profit/margin: Gross margin is calculated by subtracting direct costs from sales. Dividing it over sales will produce a gross margin %. Gross profit/margin is useful to fine-tune your pricing to generate ample gross profit to absorb a series of operating expenses.

- Net profit/margin: When total operating expenses (such as rent, staff salaries, insurance and similar) along with interest, depreciation and taxes are subtracted from gross profit, the result will be net profit. Dividing it over sales will produce a net margin %.

7.6 Cash Flow Statement

Cash flow projections will help understand the movement of cash over the projected period. It will confirm whether the company is sufficiently funded and projected to generate ample revenues to cover its expenses and other financial obligations. The cash flow statement is categorized into the following three sections:

- Cash flow from operating activities: It shows the cash ins and outs due to the company’s core operations such as sales, sales returns/refunds, direct cost, operating expenses, taxes, etc.

- Cash flow from financing activities: This segment mainly shows any inflow or outflow of cash due to increase or decrease in company’s assets such as an inflow of cash due to sale of equipment or an outflow of cash due to purchase of new equipment.

- Cash flow from investing activities: This section is mainly used to provide information about periodic investments that will be made in the company such as inflow of cash due to a new private investment or a bank loan. The outflows in this section will usually be either in form of dividends (paid to equity investors) or repayment of a bank loan.

7.7 Balance Sheet

Balance sheet reports the company’s assets, liabilities and equity.

- Assets: There are two types of asset classifications on the balance sheet, namely current assets and long-term assets. Current assets represent cash and cash equivalent as well as other assets that can be quickly redeemed into cash such as account receivables, pre-payments, inventories, etc. Long-term assets represent tangible and intangible valuable items that are needed to run the company’s operations such as computers and office equipment, machines, furniture and fixtures, software, etc. These assets are subject to periodic depreciation based on their purchase value and expected life.

- Liabilities: Liabilities represent the company’s financial obligations that it must fulfill as per their individual timeframe. Akin to assets, liabilities can be classified into current (financial obligations that are due in less than a year) and long-term liabilities (financial obligations that are due in more than a year).

- Equity: Equity is equal to the company’s assets minus its liabilities. It is also dubbed as shareholder’s capital or the company’s net worth. Its composition mainly includes paid-in capital and retained earnings.

8. Provide supporting information in the Appendix

Business plan appendix is a space where auxiliary information can be provided. The auxiliary information must support the main business plan and shall not include irrelevant information. Some of the items that can be provided in the appendix include:

- Product design

- Website design

- Supplier quotation and contact info

- Marketing collaterals

- Floor plans and seating arrangement

- Screenshot in support of any claims made in the business plan

- Contact information of partners, associates, advisors and accountants

Writing the Hotel Business Plan: How to Get Started?

Now that you’ve understood the main components of the hotel business plan, it’s time to get started with its preparation. You can either instruct a professional business planner to assist you with developing the hotel business plan or try to do it yourself.

~400

HOURS

A layperson on average spend 400 hours to produce a business plan. That’s 50 working days of full-time work – and its accuracy will still be questionable. Would you risk putting in that much efforts or engage a professional team such as Aceplans to deliver you a fully customized business plan in just a few days. Contact us today to discuss your case.

1. Instruct a Professional

Most entrepreneurs seek professional help to produce a robust business plan as it saves them plenty of time which they can utilize on other productive work.

As a professional business planning company with a record of delivering highly successful business plans, you can contact our team to discuss your case and requirements. We will revert with a bespoke package which is exclusively designed for your company to achieve any objective.

2. Do-it-Yourself

If you are committed to do it by yourself, first make sure you have the required competency to produce a business plan, including narration skills, knowledge of business and finance and research skills, including having access to premium research databases. Nevertheless, you can follow the following steps to create your business plan:

Step 1: Learn Business Plan

Make sure you are well aware about the business plan components and your industry by reading our exclusive industry-specific business plan guide for your industry.

Next, check out business planning courses, especially those that have a great amount of information on building financial models. The following learning platforms are recommended:

Step 2: Finalize the Business Plan Content

After reviewing our industry-specific business plan guide and taking an online business plan course, the next step is to finalize your business plan content.

The final business plan content will depend upon your company type, industry and objective you want to achieve with your business plan.

Step 3: Build Your Business Plan

Once the contents are finalized, it’s time to build a business plan.

- Write in a premade template: It is the simplest and quickest method to get started with your business plan.

- Free template: Microsoft Office 365 offers a range of free MS Word built-in templates for business plans. Check out free business plan templates available on Microsoft Word library. The downside of using a free template is that it lacks the strong visual impact to impress your readers, while the financial model template for projections may be missing which needs to be created from scratch.

- Premium templates: Looking for a better option? Get a beautifully and professionally designed template on GraphicRiver. Templates prices start from $7.00. The downside of using a premium template is flexibility to customize it as you may be compelled to follow the template’s fixed layout.

- Build it online: If you want to keep things simple and under control, consider building your business plan online. LivePlan offers an affordable solution to entrepreneurs to build their own business plan. The downsides of using LivePlan are recurring fee, limited customization and lack of graphics and visual appeal.