Venture Capital Business Plan is prepared to attract invesment from venture capital investors who seek opportunities to generate profitable returns in the long run. They also tend to take a more hands-on approach with portfolio businesses, providing valuable advice, guidance, and access to their professional networks and resources. This is why having a solid Venture Capital Business Plan is important to attract them.

Venture capital comes from big institutional investors who have a lot of money to invest. VC investors usually support businesses that can grow quickly and make a lot of profit by offering new and creative products or services. To generate Venture Capital investment, you should have a strong venture capital business plan that can pass through rigorous scrutiny and due diligence assessments with satisfactory results. The venture capital business plan should show how the company plans to grow quickly over time, while also being realistic. It should have awell-defined revenue model, and strong competitive advantage, supported by a skilled team that knows the business and its risks.

$209bn

VC FUNDING

VC funding has exceeded the $200 billion mark in 2022, making it the second highest year in terms of venture capital funding in the US.

72%

SHARE

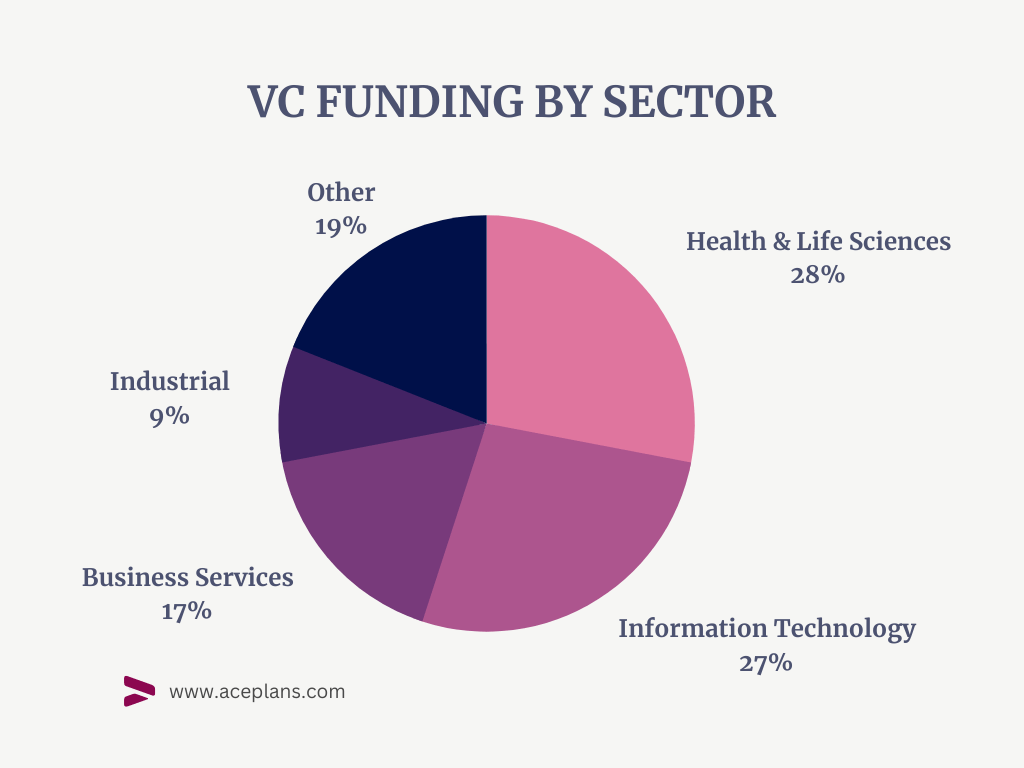

More than two-third of the VC funding went into three sectors, namely Health & Sciences, Information Technology and Business Services.

Traits of a Good Venture Capital Business Plan

A compelling narrative & strong value proposition. A business idea can arise from personal experiences, desire, or market observations. The value proposition explains why your business matters and helps venture capital investors to assesst how it helps customers. It’s crucial to include your Venture Capital Business Plan, Based on the origin and nature of the business idea (and even on the specific venture capital firm being approached), different story-telling devices, language styles, and substantiating evidence should be used in composing the value proposition.

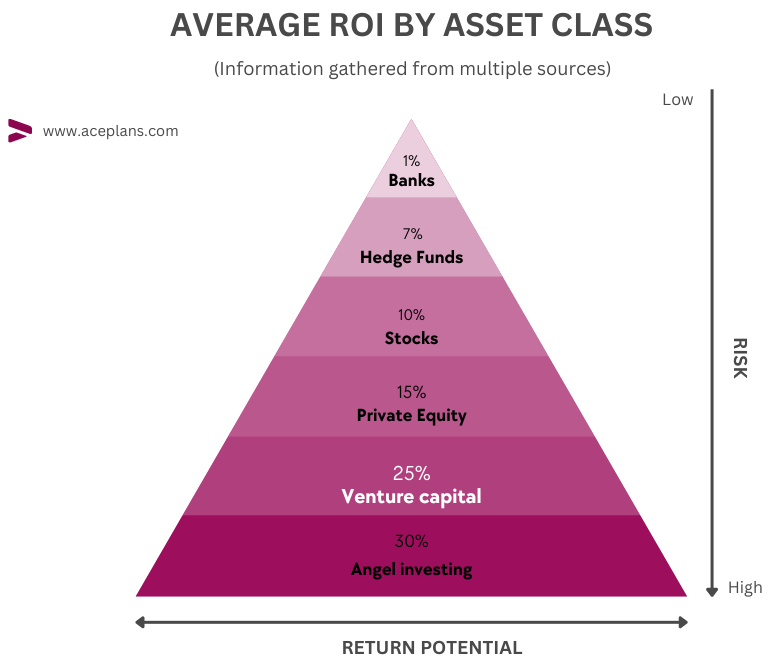

Demonstrate lucrative returns. Venture capital firms are primarily motivated to invest in businesses to achieve significant returns, surpassing those from other asset classes such as bonds, stocks, and REITs. On average, venture investors anticipate a 25% annual return, aiming to earn three times the initial investment within a five-year period.

In your venture capital business plan, it’s crucial to include realistic financial projections. These projections showcase the company’s potential to deliver substantial returns on investment. They should be grounded in sound assumptions and illustrate a definite route to profitability.

Able team of founders. The Harvard Business Review, reporting on a survey of 900 VC firms, found that a well-prepared Venture Capital Business Plan, including proper team composition and assembly, is one of the most important factors contributing to an investable company’s success. Venture capitalists seek specific qualities in teams that can turn an idea into a successful product. One key factor is the team’s diversity of skills, which should complement each other’s strengths and weaknesses. Therefore, your venture capital business plan must describe each member’s role in running the company, substantiated by their commercial and technical proficiencies, achievements, and unique experiences that put them on the entrepreneurial path.

Large addressable market. Your venture capital business plan should demonstrate the size of the company’s total addressable market and its growth potential over time. Simultaneously, a venture capitalist will be keen to know the immediately serviceable subset of the overall market, along with customer acquisition and retention strategies employed to grab and hold market share. It is also important to show how your product or service can be reproduced and scaled rapidly at a smaller marginal cost to cater to growing demand.

Our Solutions

Characterised by realistic and coherent strategies, we offer the business plan as our core solution. Our business plans are distinguished based on three main attributes – clarity, simplicity and elegance. We go to great lengths to bring clarity, no matter how complex your industry is, and replace jargons with easy-to-understand words for greater impact. We also offer a custom design that goes well with your overall branding strategy.

A pitch deck is a marketing presentation which is used by entrepreneurs to solicit funds from equity investors. A strong pitch deck can help you take the discussion with your investors to the next stage.

Act as a business resume, one-pager investment teaser is used to present an exciting business opportunity to potential investors in a snappy, yet effective manner to garner their initial interest in your company.

Package

We also offer all of the aforementioned services in a single package. This will enable you to save both time and money if all documents are produced in a chronological order in a single service.

Our Methodology

We can take the business planning work off your plate. So that, you shall focus on other things that matter the most for your company. Our methodology to prepare the business plan is outlined below:

1. Discover

We start by speaking with you about your Venture Capital Business Plan. Then we will map out the plan of action, detailing the project scope, deliverables and timeline. We will also send you a survey to gather basic information about your idea or company. It is normally succeeded by another interactive Q&A phase to fully understand your business and project specifications.

2. Preparation

Based on information obtained in preceding phase, We will start your venture capital business plan development. ou’ll get the projections for review in the first week. The intermittent plan draft will follow in the second week. By the thired week, A complete VC business plan draft will be circulated upon commencing the plan development.

3. Completion

Our aim is to promptly complete your venture capital business plan with high quality. Your feedback is crucial, and we’ll make any necessary changes before sending you the final version for your use.

4. Retain Us

Retain our services to keep your business plan up-to-date in the long-run. We will be responsible for updating the business plan as circumstances and variables change in the future. We will ensure you always have access to the up-to-date business plan to productively engage with any investors at any time.

Our Value Proposition

100%

WINNING BUSINESS PLANS

Our business plans are proven to generate results, whether it would be raising capital or steering the company’s operations to success. Our methodology also ensures your productive participation in developing the plan so that we can tailor it to exceed your expectations.

3w

AVERAGE PROCESSING TIME

Our average processing time is 3 weeks (15 working days). We can always expedite the business plan preparation to complete it quicker than 3 weeks. The fastest turnaround time we can achieve is 7 working days. The expedition is subject to our team’s availability and other terms and conditions.

2x

VALUE FOR MONEY

With our business plan services, you get two times more value for your money because of affordable pricing and amazing results.

How to Write a Venture Capital Business Plan?

The development of a venture capital business plan for every company requires a unique approach, making the plan content vary case by case. However, the following template shall help in understanding our approach to develop a venture capital (VC) business plan.