Private equity fund business plan is aimed at investment professionals managing funds of collective investment contributed by wealthy individuals, wealth and pension funds, insurance companies, endowments, and other institutional investors. The Private Equity Fund Business Plan is often sector-agnostic. It tends to invest in or buy out businesses with high potential, needing additional capital and guidance to unlock growth or turn their fortunes around.

The Private Equity Fund Business Plan focuses on finding businesses with big potential that need more money and advice to grow or improve. These funds also seek companies that can consistently make good profits and grow over time, usually selling them for a profit within 5–10 years. The private equity deals can take the form of partial or complete takeovers, providing businesses with sufficient capital to fund ambitious growth plans and access to the private equity firm’s valuable experience. A good private equity fund business plan shows how the extra cash helps the company grow, supported by robust financial projections and an analysis of growth avenues, operational plans, and the external environment.

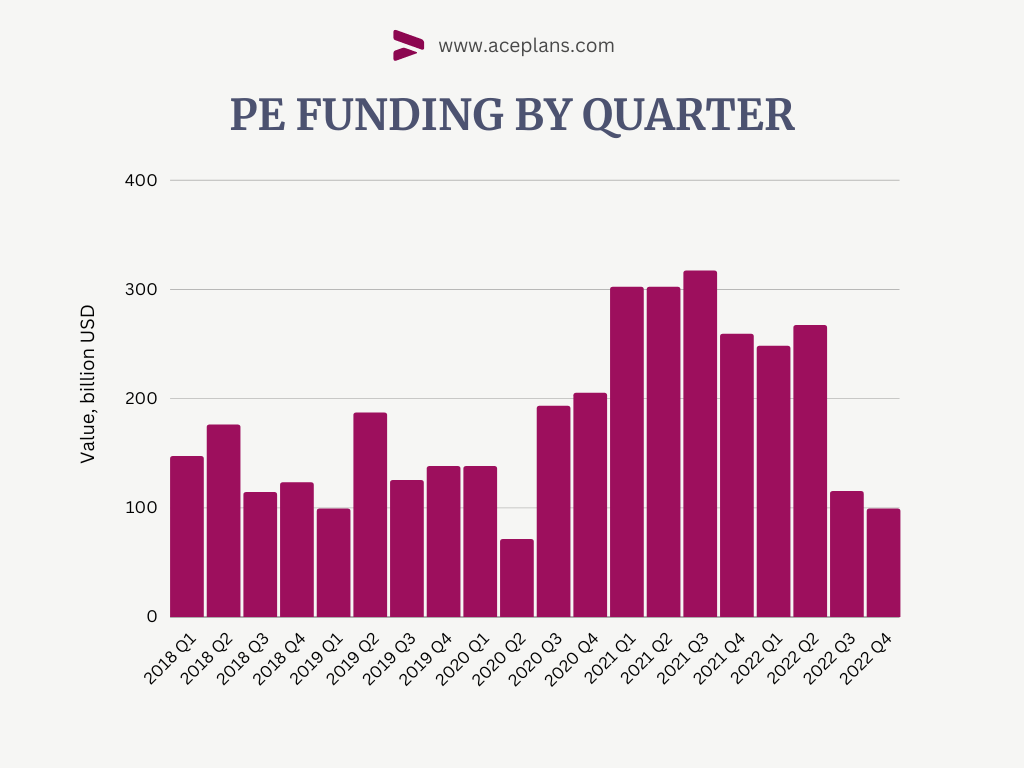

$729bn

PE FUNDING

PE funding has exceeded the $700 billion mark in 2022, marking the the second highest year of activity within the past decade.

10x–35x

VALUATION AT EXIT

Private equity funded companies tend to generate outsized returns. Prices paid per share can be anything from 10 times earnings (in M&As) to 30x earnings (IPOs).

RELATED SERVICES: Venture Capital Business Plan, Angel InvestorBusiness Plan

Traits of a Good Private Equity Fund Business Plan

Our Solutions

Characterised by realistic and coherent strategies, we offer the business plan as our core solution. Our business plans are distinguished based on three main attributes – clarity, simplicity and elegance. We go to great lengths to bring clarity, no matter how complex your industry is, and replace jargons with easy-to-understand words for greater impact. We also offer a custom design that goes well with your overall branding strategy.

A pitch deck is a marketing presentation which is used by entrepreneurs to solicit funds from equity investors. A strong pitch deck can help you take the discussion with your investors to the next stage.

Act as a business resume, one-pager investment teaser is used to present an exciting business opportunity to potential investors in a snappy, yet effective manner to garner their initial interest in your company.

Package

We also offer all of the aforementioned services in a single package. This will enable you to save both time and money if all documents are produced in a chronological order in a single service.

Our Methodology

We can take the business planning work off your plate. So that, you shall focus on other things that matter the most for your company. Our methodology to prepare The Private Equity Fund Business Plan is outlined below:

1. Discover

Our process begins with a discussion about your business concept within the framework of a private equity business plan. We’ll map out the plan of action, detailing the project scope, deliverables, and timeline. Additionally, we’ll send you a survey to gather basic information about your idea or company. This is normally succeeded by another interactive Q&A phase to fully understand your business and project specifications.”

2. Preparation

Building upon the insights and information gathered in the prior phase, we will initiate the development of your private equity business plan. Projections will be completed and sent to you for verification within the first week. Subsequently, an interim plan draft will be provided in the second week. By the third week of commencing the plan development, a complete business plan draft will be circulated for your review and feedback.

3. Completion

Upon completion of your private equity business plan. We expect you to review the full business plan and provide valuable feedback. Appropriate amendments will be made in the business plan and the final business plan will be circulated for your use.

4. Retain Us

Retain our services to keep your business plan up-to-date in the long-run. We will be responsible for updating the business plan as circumstances and variables change in the future. We will ensure you always have access to the up-to-date business plan to productively engage with any investors at any time.

Our Value Proposition

100%

WINNING BUSINESS PLANS

Our business plans are proven to generate results, whether it would be raising capital or steering the company’s operations to success. Our methodology also ensures your productive participation in developing the plan so that we can tailor it to exceed your expectations.

3w

AVERAGE PROCESSING TIME

Our average processing time is 3 weeks (15 working days). We can always expedite the business plan preparation to complete it quicker than 3 weeks. The fastest turnaround time we can achieve is 7 working days. The expedition is subject to our team’s availability and other terms and conditions.

2x

VALUE FOR MONEY

With our business plan services, you get two times more value for your money because of affordable pricing and amazing results.

How to Write a Private Equity Fund Business Plan?

The development of a business plan for every company requires a unique approach, making the plan content vary case by case. However, the following template shall help in understanding our approach to develop a private equity fund business plan.